POR AMÁLIA SAFATLE

Na medida em que a precificação for bem-sucedida em reduzir as emissões de gases de efeito estufa, tornando as condições climáticas na Terra mais seguras e, por consequência, aumentando o bem-estar da população, ela deverá afetar praticamente todo e qualquer cidadão.

A relação entre bem-estar e combate à mudança climática é cada vez mais clara. Uma recente pesquisa sobre clima e energia, que ouviu 10 mil pessoas em 75 países, comprova: 66% dos cidadãos veem na ação pelo clima uma oportunidade de melhorar sua qualidade de vida. No Brasil, o número aumenta para 87%. Os dados são da World Wide Views, iniciativa que promove consultas populares em nível global (mais sobre a pesquisa aqui).

Pode-se argumentar que, por outro lado, precificar o carbono aumentará o custo de vida, uma vez que o aumento dos preços é repassado ao consumidor e afeta principalmente as pessoas de menor poder aquisitivo.

Mas, na verdade, a precificação serve para desestimular a produção e consumo do que é intensivo em carbono, ao elevar a competitividade das tecnologias mais limpas e renováveis, o que também estimula a pesquisa, o desenvolvimento, a inovação e a geração de empregos e de renda.

Também é preciso lembrar que as populações desfavorecidas são as mais vulneráveis aos problemas ambientais gerados pela emissão de GEE, pagando, de forma difusa, um alto custo social (leia mais aqui), enquanto os ganhos da atividade econômica que gera as emissões são embolsados por quem poluiu.

Em um cenário no qual se desestimulam as atividades intensas em carbono, alguns setores que empregam muita energia de base fóssil devem ser penalizados (mais aqui). Assim, a precificação afeta diretamente a indústria de petróleo e gás, setor que exerce o maior impacto sobre o clima, e da mesma forma o setor elétrico em países onde termoelétricas a carvão ainda têm uma elevada participação. Também devem ser afetadas as indústrias siderúrgica, de cimento, de transportes e de alimentos (agropecuária), que são intensivas em carbono.

O objetivo da precificação é justamente promover a transição da velha para a nova economia, mais limpa e socialmente inclusiva. Empresas petrolíferas, por exemplo, começariam a ver maiores vantagens econômicas na exploração de fontes renováveis, como biomassa, eólica e solar.

Mas enquanto o carbono não for objeto de políticas fortes de preço e de um ambiente institucional e regulatório consistente, as alternativas renováveis não se tornam atraentes e competitivas o bastante para atrair investimentos de porte.

“As indústrias de petróleo e gás detêm forte poder econômico e por isso possuem grande capacidade de influenciar esse jogo. Ao mesmo tempo, reúnem inteligência e recursos para promover a mudança na direção de uma oferta de energia de baixo carbono”, diz Guarany Osório, coordenador do Programa de Política e Economia Ambiental do GVces.

Segundo ele, as empresas desse setor estão atentas às tendências de precificação – sabem que muito provavelmente esse movimento vai acontecer, embora ainda haja incertezas sobre quando e como. Isso gera um ambiente de instabilidade que não é nada favorável aos negócios. Tais empresas prefeririam trabalhar com cenários mais bem definidos e, mais que isso, participar da construção da mudança.

Para Carlos Rittl, coordenador do Observatório do Clima, “essas empresas entendem que, quanto antes os critérios de precificação forem definidos, melhor para elas. E quanto mais soft forem esses critérios, também”.

Além disso, são empresas que podem aproveitar o encarecimento de fontes muito poluentes, como carvão mineral, para ganhar com a exploração de gás (embora seja uma fonte fóssil, o gás é menos intensivo em carbono que o carvão). E de fazer valer os investimentos em eficiência energética e em tecnologias como captura e estocagem de carbono.

Este relatório mostra como as empresas do setor de petróleo e gás estão se preparando para o novo cenário por meio da internalização de custos relativos à precificação do carbono.

Em junho de 2015, seis delas – BG Group, BP, Eni, Royal Dutch Shell, Statoil e Total – anunciaram “um apelo aos governos de todo o mundo e à Convenção-Quadro das Nações Unidas sobre Mudança do Clima (UNFCCC) para introduzir sistemas de precificação de carbono e criar uma política clara, ambiciosa e estável, que poderia eventualmente conectar sistemas nacionais. Isso reduziria as incertezas e incentivaria maneiras mais eficientes de reduzir as emissões de carbono de forma ampla” (leia mais aqui e aqui).

Ao mesmo tempo, as três maiores empresas petrolíferas americanas – Chevron, ExxonMobil e ConocoPhillips – não apoiam a precificação, conforme publicado neste artigo da organização Think Progress, que traz uma visão cética sobre os posicionamentos do setor de petróleo de gás.

Uma boa notícia que corre em paralelo é que o cerco aos combustíveis fósseis tende a aumentar. Os países reunidos em Adis-Abeba, na Etiópia, na 3ª Conferência Internacional sobre o Financiamento para o Desenvolvimento chegaram a um acordo para financiar a nova agenda de desenvolvimento sustentável pós 2015. Os representantes das nações concordaram com várias medidas para reformar práticas financeiras globais, entre elas eliminar os subsídios dados ao setor de combustíveis fósseis.

Rittl, do Observatório do Clima, lembra ainda que Agência Internacional de Energia recomenda que 75% das reservas conhecidas de petróleo, carvão e gás fiquem no subsolo, em linha com o esforço de limitar o aquecimento global.

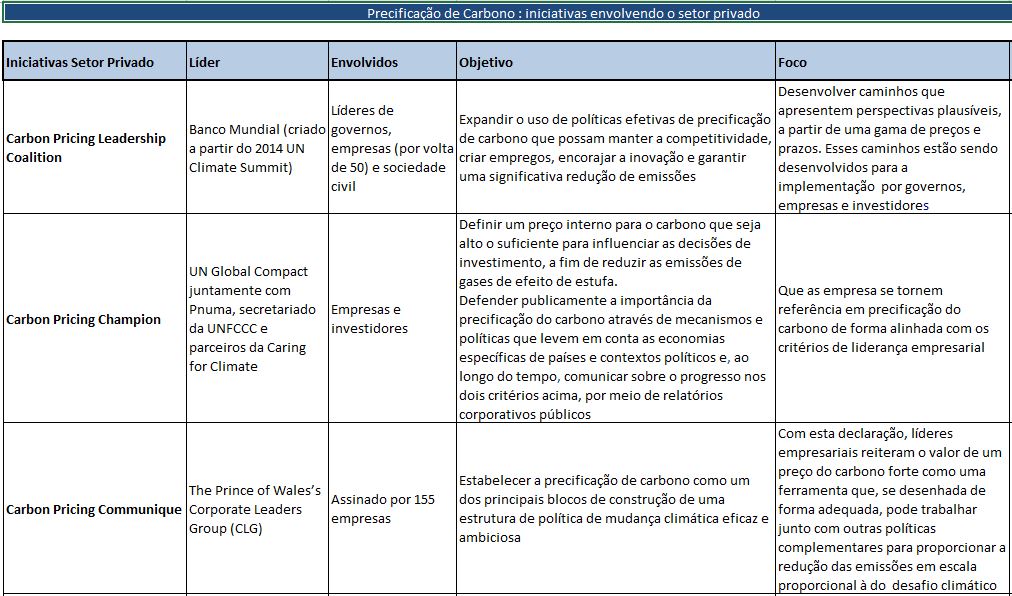

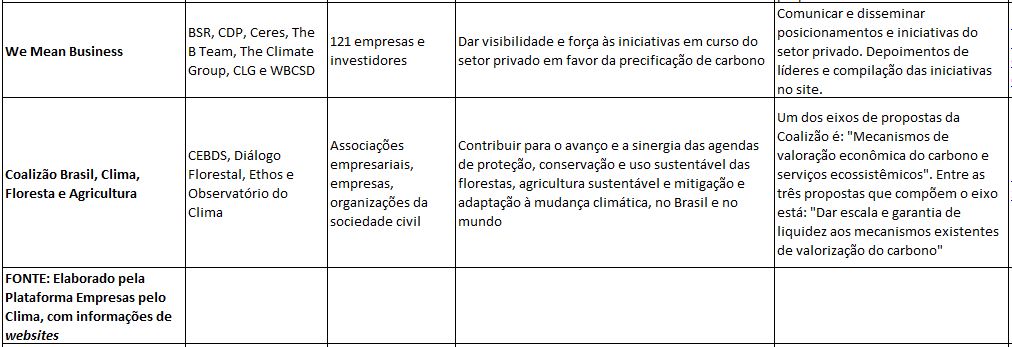

Enquanto isso, algumas redes e organizações empresariais privadas que apoiam a precificação ganham corpo ao redor do mundo. Conheça no quadro abaixo as principais iniciativas, quais os objetivos e os líderes e atores envolvidos em cada uma:

Um dos projetos da Carbon Pricing Leadership Coalition tem como objetivo mostrar o papel efetivo da precificação para uma economia de baixo carbono, informa Juliana Lopes, diretora para a América Latina da CDP, uma das organizações integrantes da coalizão. O intuito é oferecer um cenário factível para apoiar decisões de governo e construir políticas públicas, além de facilitar a gestão de riscos climáticos por executivos e investidores.

Segundo ela, o resultado da primeira fase desse projeto foi apresentado em painéis com os membros da Carbon Pricing Leardership Coalition e passará por um processo de consulta pública, com sessões de engajamento com diversos stakeholders (públicos interessados). Assim, serão capturadas as opiniões de múltiplos tomadores de decisão em diversos países. Considerados esses inputs, o resultado geral desse projeto deverá ser publicado em 2016.

O relatório da Cambridge Institute for Sustainability Leadership analisa o avanço do setor privado em mitigação na Europa a partir do início da operação do sistema europeu de comércio de emissões. Confira como os CEOs das empresas enxergam o mercado e quais são as motivações para se engajarem em esforços de redução de emissões, mesmo quando o preço do carbono está baixo.

E, no Brasil, a carta aberta do Fórum de Ação Empresarial pelo Clima (Fórum Clima) sinaliza mais um posicionamento do setor privado em favor da precificação.